We just finished another exciting year in the field of synthetic biology. 2017 saw the release of several new biomanufactured products, the approval of the first gene therapy drug, and the continued development of a transformative technology. Here, I have delved into my database of venture capital activity in synthetic biology to present some numbers on the current state of synthetic biology investing.

Synthetic biology startups had a great year, raising over $1.4 billion of venture funding and setting a new record for money raised. This marks the largest amount of venture money ever raised by synthetic biology companies and a 40% increase from last year. A record amount of money being put into startups isn’t exactly novel - 2017 was a record setting year for venture fundraising in general as many unicorns raised mega rounds - but the growth in synthetic biology funding is far outpacing the general growth of startup funding.

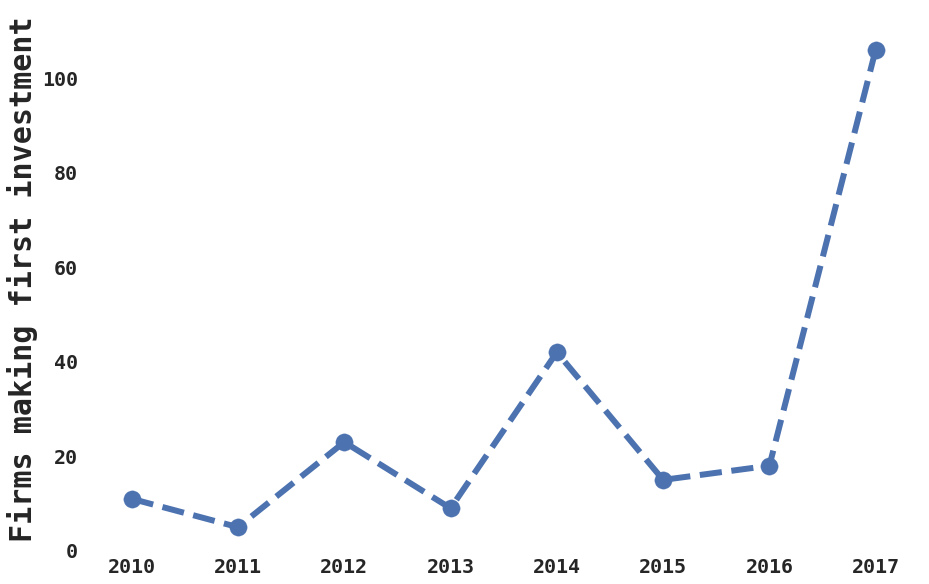

Broadly, 2017 marked a continued decrease in the number of venture fundings, down from a peak in 2014. However, the number of deals closed by synthetic biology startups (below, blue) increased slightly from 2016, though they did not manage to reach the same number that set a record in 2015. The fact that we hit a record amount of money raised without a record amount of rounds indicates that the size of venture rounds is increasing as some companies start to mature their business plans. Also in contrast to the broader venture capital ecosystem, the number of startups that raised their first equity investments (green) reached a new record this year. It seems that there is no shortage of quality applications of synthetic biology for investors to buy into.

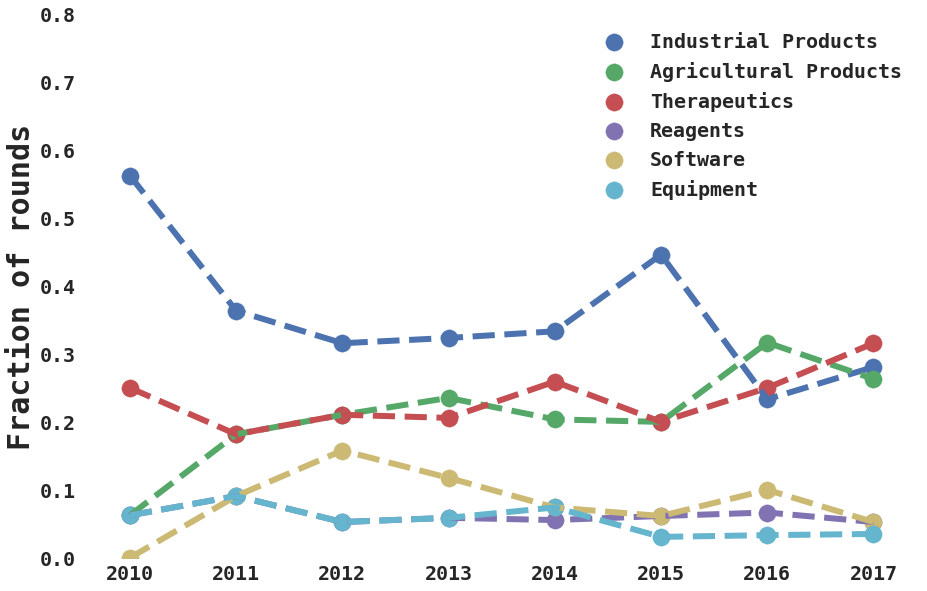

Looking at the distribution of applications, investors during 2017 continued to exhibit an increased interest in medical and agricultural companies as industrial companies have lost their shine from 2010. Synthetic biology supporting companies in reagents, software, and equipment make up a small but important fraction of the deals closed.

As the promise of synthetic biology becomes more and more obvious, investors are pouring into the space. Over 100 investors made their first synthetic biology investment during 2017, which was a huge leap over previous years. Much of these new investors are coming to synthetic biology without a life sciences background, and will be able to contribute a unique point of view to the companies they are involved with.

With their intense focus on incubating early-stage synthetic biology companies, it is no surprise that SOSV, the funder behind IndieBio and RebelBio, tops the list of most active investor in synthetic biology. Second place goes to Alexandria, the real estate development group that builds life science clusters. Accessing lab space may be one of the most challenging aspects to synthetic biology entrepreneurship, so the fact that the top two most active investors are both involved in offering space to their companies is no coincidence, and may provide a lesson to others who wish to get involved in synthetic biology investing. Tied for third place are a number of investors who all made three investments in synthetic biology during 2017. What is interesting about this group is the broad range of investor histories. From agriculture-focused institutional investor Syngenta Ventures to traditional biotech-focused Orbimed to impact investor Bill Gates, the interest in synthetic biology is quite diverse.

| Investor | Rounds |

|---|---|

| SOSV | 20 |

| Alexandria | 5 |

| Bill Gates | 3 |

| Bioeconomy Capital | 3 |

| Khosla Ventures | 3 |

| Lewis & Clark Ventures | 3 |

| Orbimed | 3 |

| Syngenta Ventures | 3 |

| Y Combinator | 3 |

Though synthetic biology companies are tackling a broad range of applications and being funded by a broad range of investors, they are not being founded in a broad range of environments. The vast majority of companies are headquartered in northern California or the Northeast, with few outside of those areas receiving funding. Outside of the US, most companies are founded in Europe or Canada. Though some areas had little investment, it is interesting to see that they are excelling in different applications of synthetic biology. Canada and the Midwest are dominated by agricultural companies and the Northeast by therapeutics companies. The lack of investment outside of a few concentrated areas is concerning. There are a large number of individuals with expertise in agriculture in the Midwest, Florida, and Texas, and those with expertise in industrial chemicals in Texas, Europe, and Asia. Investors who ignore these areas are likely to miss out on companies whose leadership has extensive knowledge of the problem they are trying to solve.

| Region | Deals closed | Most prominent sector |

|---|---|---|

| Northern California | 19 | Industrial |

| Northeastern US | 14 | Therapeutic |

| Europe | 6 | Therapeutic/Agricultural |

| Southern US | 4 | Therapeutic/Agricultural |

| Canada | 4 | Agricultural |

| Pacific Northwest US | 3 | Industrial |

| Southern California | 2 | IT/Agricultural |

| Other International | 2 | Therapeutic |

| Midwestern US | 2 | Agricultural |

| Rocky Mountains US | 1 | Industrial |

Overall, synthetic biology had another banner year in 2017, and continues to gain legitimacy as a field that will disrupt a broad range of industries. 2018 will hopefully see more investors moving into the field and the continual funding of early and late-stage companies in a diverse set of applications and geographies. It’s an certainly an exciting time to be involved in the field!